Wall Street suffers worst week since 2020 amid rate concerns

Xinhua

23 Jan 2022, 03:19 GMT+10

"We're three weeks into the year and this is probably one of the worst starts that I've seen," says Larry Benedict.

NEW YORK, Jan. 22 (Xinhua) -- U.S. equities extended losses for the past week, with the Nasdaq and the S&P 500 notching their worst week since the onset of the COVID-19 pandemic.

For week ending Friday, the S&P 500 and the tech-heavy Nasdaq shed 5.7 percent and 7.6 percent, respectively, both wrapping up their worst weeks since March 2020. The Dow dropped 4.6 percent, its steepest weekly fall since October 2020.

The Nasdaq has dropped for four straight weeks, while the S&P 500 and Dow each booked three consecutive weeks of losses, according to Dow Jones Market Data.

"We're three weeks into the year and this is probably one of the worst starts that I've seen," Larry Benedict, CEO & founder of The Opportunistic Trader, a U.S. market research firm, told Xinhua.

"Usually, at the beginning of the year, you'll see some buying, but you're not really seeing that," he said.

The overall market was under pressure and the U.S. tech shares entered a technical correction this week, with the Nasdaq down nearly 15 percent from its mid-November high, nearing the 20 percent decline from a recent peak that would meet the commonly used definition for a bear market.

Investors fret over elevated bond yields, the prospect of higher interest rates and their impact in valuations, according to analysts.

The yield on the benchmark U.S. 10-year treasury hit 1.9 percent earlier this week, before retreating on Friday, as investors prepared for Federal Reserve's monetary policy tightening.

"The original headwind of the week is that bond yields on the 10-year note," said Benedict, adding "people are worried that the economy is gonna slow drastically" as they expected several rate hikes by the Fed.

The seasoned analyst said he expected the Fed is "going to raise more significantly than people think."

"There's a potential for the first rate rise to be 50 basis points, not 25, which would be probably the right move, but a little bit shocking to the market," said Benedict.

Fed Chair Jerome Powell said that the central bank would have to raise rates more if inflation remains elevated.

He referred to inflation as a "severe threat" to the economic rebound, compared to the "transitory" designation that existed just three months ago.

Powell said the Fed is preparing to raise interest rates and that the economy no longer needed extraordinary accommodation, signaling that the central bank may also begin to trim its balance sheet soon after it commences rate increases.

The Fed is on track to conclude its asset purchase program in mid-March as it exits from the ultra-loose monetary policy enacted at the start of the pandemic.

Fed officials' median interest rate projections released mid-December showed that the central bank could raise rates three times this year, up from just one rate hike projected in September.

On the corporate side, Netflix became the first big tech name to report earnings this season. The stock slumped more than 21 percent on Friday after the U.S. streaming giant's fourth-quarter earnings report showed a slowdown in subscriber growth.

Tech giants Apple and Tesla are slated to report next week.

On the economic front, the U.S. Department of Labor reported on Thursday that U.S. initial jobless claims rose by 55,000 to 286,000 in the week ending Jan. 15. Economists polled by The Wall Street Journal had forecast new claims to total a seasonally adjusted 225,000.

Looking ahead, analysts warned of a bumpy path for U.S. equities in the year as a more hawkish Fed, high and persistent inflation and COVID-19 uncertainty are among the factors complicating the outlooks.

The S&P U.S. Listed China 50 index, which is designed to track the performance of the 50 largest Chinese companies listed on U.S. exchanges by total market cap, logged a weekly slide of 3.6 percent.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of International Travel News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to International Travel News.

More InformationBusiness

SectionNvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...

Tech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Lululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Travel and Tourism

SectionNative leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

UN offer rejected in Dreamliner crash investigation

NEW DELHI, India: India has decided not to allow a United Nations (UN) investigator to join the investigation into the recent Air India...

Thailand-Cambodia tensions rise as border rules tighten

BANGKOK, Thailand: This week, Thailand implemented land border restrictions, including a ban on tourists traveling to Cambodia, as...

PM Modi says cabinet decision to widen National Highway section in Tamil Nadu will boost tourism, economic growth

New Delhi [India], July 1 (ANI): Prime Minister Narendra Modi on Tuesday lauded the decision of the Union cabinet to approve the construction...

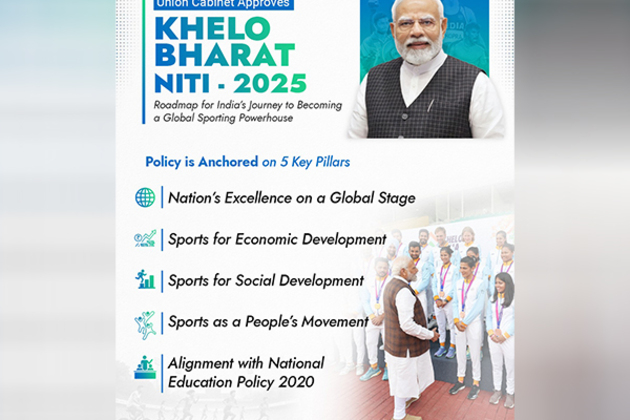

"Landmark day for India's efforts to encourage sporting talent": New National Sports Policy 2025 approval

New Delhi [India], July 1 (ANI): On the occasion of the approval of the new 'Khelo Bharat Niti 2025', Prime Minister Narendra Modi...

Tanda Medical college to become state's premier healthcare institution within a year: Himachal CM Sukhu

Shimla (Himachal Pradesh) [India], July 1 (ANI): Himachal Pradesh Chief Minister Sukhvinder Singh Sukhu said that the Government is...