FPI sell-off continues for 9-month, pulled out equities worth Rs 50,203 cr in June

ANI

02 Jul 2022, 09:48 GMT+10

New Delhi [India], July 2 (ANI): Foreign portfolio investors (FPIs) have pulled out Rs 50,203 crore worth of equities from India in the month of June, according to the latest National Securities Depository data.

FPIs have been persistently selling equities in the Indian markets for the past nine-to-ten months due to various reasons, including tightening of monetary policy, rising current account deficit on account of depreciation of rupee, rising dollar and bond yields in the US.

FPIs typically preferred advanced economies in times of sharp volatility and uncertainty in the overall financial markets.

So far in 2022, they sold equities worth Rs 217,619 crore, NSDL data showed. During the same period, Sensex and Nifty declined over 10 per cent each.

"This massive capital outflow has significantly contributed to the depreciation in INR which breached 79 to the dollar recently. The relentless FPI selling has to be seen in the context of a steadily rising dollar and bond yields in US," said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

"FPIs are selling more in countries with rising current account deficits like India because the currencies of such countries are vulnerable to further depreciation. Towards the end of June FPI selling has been showing a declining trend."This trend will be halted only when the dollar stabilises and US bond yields decline, Vijayakumar added. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of International Travel News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to International Travel News.

More InformationBusiness

SectionWall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Travel and Tourism

SectionUN offer rejected in Dreamliner crash investigation

NEW DELHI, India: India has decided not to allow a United Nations (UN) investigator to join the investigation into the recent Air India...

Thailand-Cambodia tensions rise as border rules tighten

BANGKOK, Thailand: This week, Thailand implemented land border restrictions, including a ban on tourists traveling to Cambodia, as...

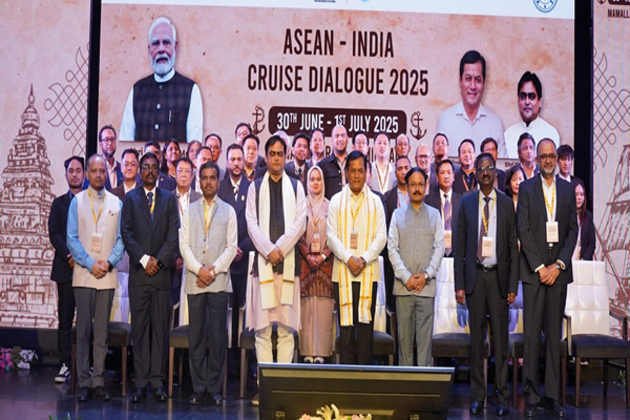

"India to work with ASEAN nations to develop cruise tourism hub of global south": Sarbananda Sonowal

Chennai (Tamil Nadu) [India], June 30(ANI): The Union Minister of Ports, Shipping & Waterways (MoPSW), Sarbananda Sonowal inaugurated...

Varnas Summer Boost: German Tourists lead 29% Growth in Arrivals

Varna has kicked off the 2025 summer season on a strong note, with a notable increase in tourist arrivals and overnight stays during...

Agarwood industry blossoms in China's Hainan

HAIKOU, June 30 (Xinhua) -- In the processing workshop of Hainan Changshu Seedling Development Co., Ltd. in Chengmai County, south...

Foreign visitors to Korea reach 1.63 million in May

SEOUL, 30th June, 2025 (WAM) -- The Korea Tourism Organisation announced that the number of foreign tourists who visited the country...